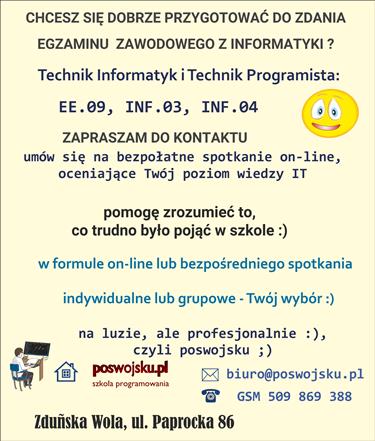

Szkolenia informatyczne: biuro, technologie internetowe, egzaminy technik

CENA - OFERTA: Jesteś zainteresowany/na kursem – zapraszam do kontaktu ze mną, szczegóły: www.poswojsku.pl .

Futures contract. Futures market. Stock exchange derivatives

Futures contract. Futures market. Stock exchange derivatives 2023

In addition to debt instruments in the short term, the so-called derivative financial instruments.

A derivative financial instrument (derivative, derivative, futures) is a financial instrument whose value depends on the value of another instrument (in particular a security) to which the derivative has been issued. Derivatives perform three basic functions:

1. insurance - derivatives are used to hedge against the increase (decrease) in the value of the original instrument;

2. speculative - derivatives are used to achieve the benefits of an increase (decrease) in the value of the primary instrument;

3. ensuring the desired structure of revenues.

Each derivative is a contract characterized by cash flows paid or received by participants of this contract. In this connection, instruments can be distinguished:

1. based on futures contracts;

2. based on options.

In the case of futures transactions, there is always positive cash flow - there will always be cash flow on the dates specified in the contract (settlement dates), because this type of transaction creates an irrevocable liability - the need to perform the contract within a predetermined period.

The basic types of this type of transaction are given in the figure below:

Futures contract. Futures market. Stock exchange derivatives

The contract for the WIG20 index is the most popular in our country - you will find the details of the WIG20 futures contract in the next guide.

Futures contract - it is a financial instrument that obliges two parties to enter into transactions in the future on the terms specified in the contract. The issuer of the contract takes a short position and undertakes to deliver the subject of the contract on the agreed date. The buyer of the contract takes a long position and undertakes to pay the agreed price upon delivery of the subject of the contract. The subject of the contract assumes the role of the primary instrument.

Three different prices are associated with this contract:

- the price of the futures contract on the day of conclusion of the contract;

- futures contract price on the market;

- the current price of the subject of the contract.

Most often, futures contracts are issued for:

1. currency;

2. indexes;

3. interest on securities;

4. goods.

poswojsku.eu

poswojsku.eu