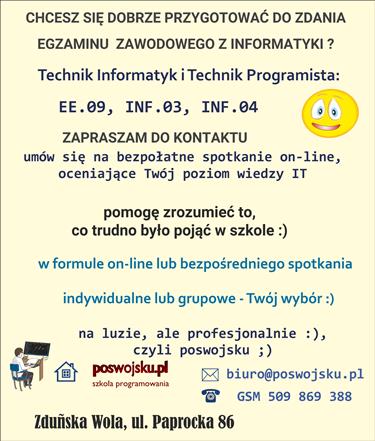

Szkolenia informatyczne: biuro, technologie internetowe, egzaminy technik

CENA - OFERTA: Jesteś zainteresowany/na kursem – zapraszam do kontaktu ze mną, szczegóły: www.poswojsku.pl .

Financial market, money, investing, borrowing, securities

Financial market, money, investing, borrowing, securities

The financial market began to shape in Poland after the transformation of 1989, following the example of the markets of highly industrialized countries. Instruments previously unknown in our country appeared on the financial market and financial market institutions were created:

1. KPW - Securities Commission - legal regulation of trading in financial instruments;

2. GPW - Warsaw Stock Exchange and KDPW - National Depository for Securities - organization of trading in financial instruments.

Along with the new instruments, new cash investment opportunities and associated completely new threats appeared.

When considering the issue of financial investments, one cannot ignore - due to its importance - the stock market and the currency market - FOREX. Investors cause the flow of funds - money (currencies) between different markets.

Financial market, money, investing, borrowing, securities - MONEY

MONEY COSTS MUCH ONLY, BUT ONLY BY A FRACTION OF A SECOND

Money is a universal equivalent of commodity exchange and is an intermediary in this exchange. At the same time, it is influenced by all factors that affect the goods. The most important are:

- money demand (given currency),

- money supply (of a given currency),

- shortage or excess of money (of a given currency),

- value over time and

- all regulations - restrictions imposed by the monetary authorities on the free circulation of money.

These factors and many others mean that money dealing entities, and in particular cash flow flows, must manage them in such a way as to minimize the risk and associated losses from fluctuations in interest rates and exchange rates.

One of the basic principles that should be applied in every enterprise is effective financial management. Activities in this area should enable, on the one hand, obtaining funds for the enterprise's activities, and on the other - their most effective investment. It is very important to coordinate the acquisition and investment of company resources.

Financial market, money, investing, borrowing, securities - ACQUISITION FUNDS - MONEY

Speaking of raising funds, they should be divided into:

- funds needed for the company's turnover activity (time period up to a maximum of one year - depends on the length of the production cycle);

- funds needed for investment activities (period of time over one year - depends on the type of business of the company).

Activities in the field of financial management of an enterprise should also lead at least to maintaining the real value of the resources (including acquired) and very often determines the success or failure of the enterprise.

Financial market, money, investing, borrowing, securities - INVESTMENT

The best way to defend the real value of your resources are through various types of investments - they can be made in the field of:

- fixed assets (buildings and structures, machinery and equipment, means of transport, etc.);

- intangible assets (software, production licenses);

- financial fixed assets (securities).

You can talk about active and passive investments. The first are aimed at increasing the real size of the company's resources, while the second are limited to maintaining the real size of its resources. The question arises: "Which of these types of investment should enterprises use?"

The answer to the above question is very complicated. In principle, it may seem that it is enough when an enterprise defends its ownership. However, this is quite a risky course of action, as it may not be enough for the enterprise to survive - for example, due to a rapidly developing technique. On the other hand, entrepreneurs who focus on active investments - must take into account the simultaneous large increase in risk, which very often increases in a proportional or even larger way. Therefore, enterprises should strive to diversify their investments in various economic enterprises, i.e. create so-called investment portfolios whose main idea is to secure risky ventures with others for which the risk can be taken as close to zero (e.g. State Treasury bonds). financial market , i.e. the market in which financial transactions are concluded, consisting of the purchase and sale of financial instruments, where the financial instrument can be defined as a contract regulating the financial relationship between two parties, in which both parties remain.

When considering the company's activity, it should be remembered that it can be carried out in different areas and in different periods of time.

poswojsku.eu

poswojsku.eu